Are you planning to launch an e-commerce store in Dubai or anywhere in the UAE? Or perhaps you already have a Shopify-based online shop in the region? A crucial aspect of your business success is the ability to accept online payments from customers. This requires integrating a payment gateway that not only supports Shopify but also processes transactions in UAE dirhams (AED).

In this article, we’ll explore the various payment gateway options available in the UAE that are compatible with Shopify. We’ll focus on solutions that allow your customers to pay online in AED using credit and debit cards, Apple Pay, and other popular payment methods. Understanding these options will help you choose the best payment solution for your e-commerce business in the UAE. We will also describe the process of creating accounts with these gateways and provide an overview of the associated costs. If you need any help integrating payment gateway with your Shopify store you can hire an expert Shopify developer.

Table of Contents

What is Shopify?

Shopify is a world-leading provider of hosted e-commerce solutions, used by millions of businesses globally. It offers an easy way to create your online store, making it one of the fastest-growing e-commerce platforms in the UAE due to its simplicity and flexibility.

Key features of Shopify include:

- User-friendly store creation

- Support for Arabic website versions, catering to Arabic-speaking users in the UAE and the Middle East

- A rapidly growing community and ecosystem

- Thousands of apps are available to extend store functionality

These attributes make Shopify stand out among e-commerce platforms today, offering a comprehensive solution for businesses of all sizes.

Why need a payment gateway that supports AED payment?

- Online payment integration is essential for e-commerce functionality. To accept payments online, you must integrate a payment gateway with your website.

- For UAE-based e-commerce stores, it’s crucial to allow customers to pay in UAE dirhams (AED). This should be possible using various payment methods including:

- Credit cards

- Debit cards

- Apple Pay

- Google Pay

- Other local payment options

- A robust online payment system is a key factor in the success of an e-commerce store. It provides convenience to customers and helps build trust in your business.

By choosing a payment gateway that supports AED transactions and offers multiple payment methods, you cater to local customer preferences and create a smoother shopping experience.

What are the payment gateways that support the Shopify platform in the UAE

Here is the list of payment gateway which support Shopify and UAE Dirhams currency.

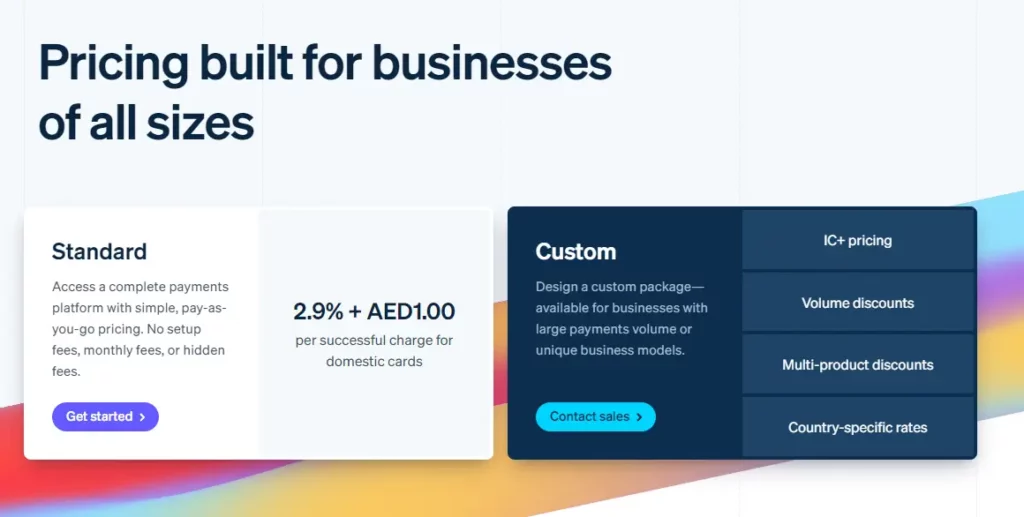

#1. Stripe

Stripe is a global payment gateway provider known for its robust and comprehensive solutions that cater to businesses of all sizes. Although Stripe is not available in the UAE, it offers a powerful payment platform for countries where it operates, providing seamless integration with e-commerce platforms like Shopify. Stripe’s pricing model is designed to be straightforward with no hidden fees, making it an attractive option for many online businesses. To activate a Stripe account, businesses and individuals need to submit specific documents for verification, ensuring a secure and compliant setup process.

Features:

- Credit and debit card payments

- 3D secure verification

- Card account updater

- Adaptive acceptance

- Network tokenization

- Dispute management

Pricing:

- Domestic Cards: 2.9% + AED 1.00 per successful charge

- International Cards: 2.9% + AED 1.00 per successful charge + 1% for international cards + 1% if currency conversion is required

Method to Activate Stripe for Businesses and Individuals in the UAE:

To activate a Stripe account in the UAE, you need to upload specific business and identity documents for verification.

- For Businesses:

- Trade license

- Memorandums of association

- Proof of an active bank account

- For Individuals:

- Color copies of passports

- Emirates IDs

- Residence visas for company representatives and all owners with 25% or more ownership in the business

Stripe offers a robust and secure payment gateway solution tailored for businesses of all sizes, ensuring smooth transactions and comprehensive support for various payment methods.

For more information please visit: https://support.stripe.com/questions/uae-account-verification

#2. PayTabs

PayTabs is a fast-growing digital and social payment solution for small and large businesses in the UAE. It provides a payment gateway platform for merchants, enabling secure online payments on their e-commerce stores. PayTabs supports multi-currency transactions, making it an ideal choice for businesses in the UAE that also want to sell products in other Middle Eastern countries. This flexibility allows merchants to cater to a wider audience by accepting payments in various currencies.

Features:

- Secure online payment processing

- Multi-currency support

- Fraud prevention and security measures

- Integration with various e-commerce platforms

- Recurring billing options

- Comprehensive reporting and analytics

Pricing

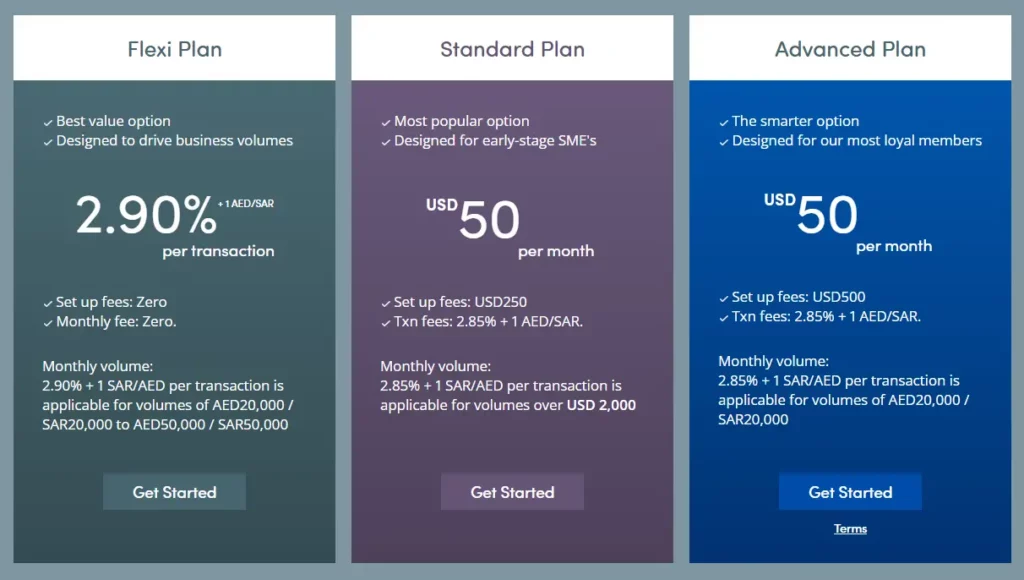

There are 3 plans to choose from

- Flexi plan

- Standard plan

- Advanced plan

Flexi Plan:

- Best value option designed to drive business volumes.

- Rates: Flat rate of 2.90% + 1 AED/SAR per transaction

- Setup Fees: Zero

- Monthly Fee: Zero

- Monthly Volume:

- Applicable for volumes of AED 20,000 / SAR 20,000 to AED 50,000 / SAR 50,000

- When signing up, choose the plan based on expected volume and sign the corresponding agreement. The account will be evaluated every 3 months. If the volume is consistently below AED 20,000 / SAR 20,000, the agreement will be changed to the Standard Plan automatically.

Standard Plan:

- Most popular option designed for early-stage SMEs.

- Monthly Fee: USD 50

- Setup Fees: USD 250

- Transaction Fees: 2.85% + 1 AED/SAR

- Monthly Volume:

- Applicable for volumes over USD 2,000 only. If the volume is less than USD 2,000 per month, only USD 50 will be charged.

Advanced Plan:

- Smart option designed for loyal members.

- Monthly Fee: USD 50

- Setup Fees: USD 500

- Transaction Fees: 2.85% + 1 AED/SAR

- Monthly Volume:

- Applicable for volumes of AED 20,000 / SAR 20,000 and above

- When signing up, choose the plan based on the expected volume and sign the corresponding agreement. The account will be evaluated every 3 months. If the volume is consistently below AED 20,000 / SAR 20,000, the agreement will be changed to the Standard Plan automatically.

Enterprise Corporate Plan:

- For bespoke plans with expected volumes of over AED 50,000 / SAR 50,000 a month, get in touch directly with PayTabs sales representatives.

Method to Activate PayTabs for Businesses:

To activate a PayTabs account in the UAE, complete the registration process and provide the following documents for verification:

- For Businesses:

- Trade license

- Company registration documents

- Proof of business address

- Proof of an active bank account

PayTabs offers a robust and user-friendly payment gateway solution, making it easier for businesses in the UAE to manage and process online transactions securely.

For the latest pricing update please visit here

#3. Telr

Telr is MENA’s first PCI DSS Level 1 certified company, providing a highly secure and reliable payment gateway solution. With 100% proprietary technology, Telr offers a full-stack, feature-rich payments solution built completely in-house. This allows for high customizability, enabling customers to accept payments online and through a wide range of alternative payment channels. Recognized as an award-winning payment gateway in the Middle East, Telr stands out for its innovation and comprehensive features.

Features:

- PCI DSS Level 1 certified for maximum security

- Full-stack, feature-rich payment solution

- Highly customizable platform

- Supports online payments and a wide range of alternative payment channels

- Integration with various e-commerce platforms

- Fraud prevention and security measures

- Recurring billing options

- Comprehensive reporting and analytics

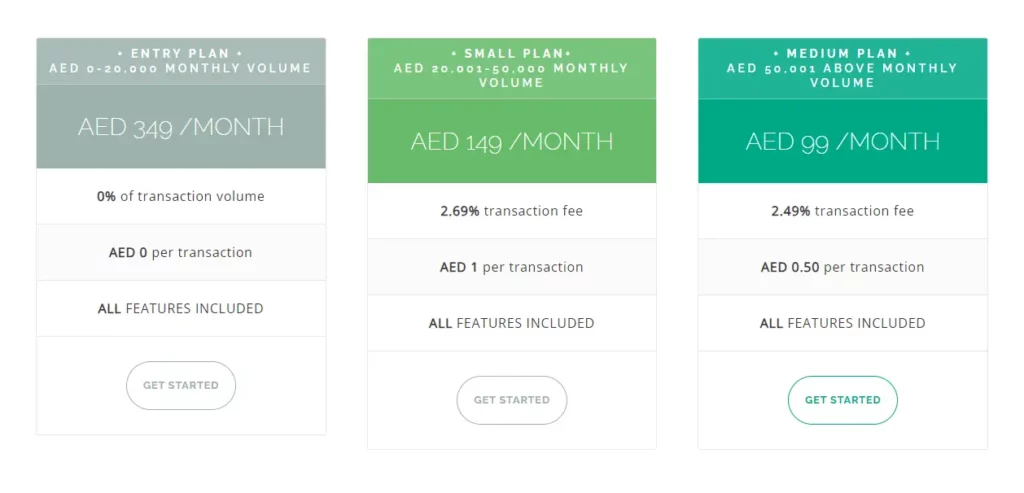

Pricing Plans:

Starter Plan:

- Ideal for new and small businesses

- Setup Fees: AED 349

- Monthly Fees: AED 99

- Transaction Fees: 2.85% + AED 1 per transaction

- Monthly Volume: Suitable for businesses with lower transaction volumes

Small and Medium Business Plan:

- Designed for growing businesses

- Setup Fees: AED 349

- Monthly Fees: AED 149

- Transaction Fees: 2.75% + AED 1 per transaction

- Monthly Volume: Suitable for businesses with moderate transaction volumes

Corporate Plan:

- Tailored for large businesses with high transaction volumes

- Setup Fees: Custom pricing

- Monthly Fees: Custom pricing

- Transaction Fees: Custom pricing

- Monthly Volume: Suitable for businesses with high transaction volumes

Method to Activate Telr for Businesses:

To activate a Telr account in the UAE, complete the registration process and provide the following documents for verification:

- For Businesses:

- Trade license

- Company registration documents

- Proof of business address

- Proof of an active bank account

- Identification documents for company representatives and owners

Telr offers a robust and flexible payment gateway solution, making it easier for businesses in the UAE to manage and process online transactions securely.

Shopping Cart Integration

Telr offers secure plugins for various shopping carts, enabling seamless integration of your website with Telr’s payment gateway in just a few minutes. Whether you’re using Magento, OpenCart, PrestaShop, Shopify, or WooCommerce, Telr has you covered. These plugins ensure a smooth and efficient setup process, allowing you to quickly start accepting payments online with enhanced security and reliability. By supporting a wide range of popular e-commerce platforms, Telr provides a flexible solution that meets the diverse needs of businesses in the UAE and beyond.

For more information please visit https://telr.com/pricing/

#4. 2Checkout (Verifone)

2Checkout, now known as Verifone, is a leading all-in-one monetization platform that maximizes your revenues and simplifies global online sales. With its modern commerce solutions, Verifone allows businesses to quickly expand internationally and optimize recurring revenue streams across multiple channels. By simplifying the back-end complexities of modern digital commerce, Verifone ensures a seamless and efficient monetization process for businesses of all sizes. This robust platform is designed to meet the diverse needs of today’s digital marketplace, enabling companies to achieve rapid growth and streamlined operations.

2SELL

Easy and simple way to sell globally

- Pricing: 3.5% + $0.35 per successful sale

- No credit card required: You’ll only pay when you start selling.

- What You Get:

- Sell instantly in 200 countries/territories

- Integrate quickly with any of 120+ carts

- Scale up for international growth

- Sell any type of product

- Access to recurring billing

2SUBSCRIBE

Develop & Boost your subscription business

- Pricing: 4.5% + $0.45 per successful sale

- No credit card required: You’ll only pay when you start selling.

- What You Get:

- Includes all 2Sell benefits

- Retain more customers & reduce churn

- Smart subscription management tools

- Manage renewals and upgrades

- Cover the entire subscription lifecycle

- Insights through subscription analytics

2MONETIZE

All-in-one solution to sell DIGITAL GOODS globally

- Pricing: 6.0% + $0.60 per successful sale

- No credit card required: You’ll only pay when you start selling.

- What You Get:

- Includes all 2Subscribe benefits

- Global tax & regulatory compliance

- Invoice management

- Reduce backend internal work

- Access to 45+ payment methods

- Optimize conversion rates

- Help with shopping cart customization

4ENTERPRISE

Custom Pricing for businesses that want to scale up

- Talk today with our sales team for high sales volumes and customized solutions.

- What You Get:

- Premium onboarding

- Dedicated support

- Professional services

- Custom integration

- Affiliate network

Verifone provides a comprehensive and flexible payment solution, making it easier for businesses to manage and process transactions on a global scale.

For more details please visit: https://www.2checkout.com/pricing/

#5. PayPal

PayPal is a world-leading payment processing platform known for its ease of use, security, and global reach. Now available in the UAE, PayPal offers businesses and consumers a reliable way to send and receive payments online. With its user-friendly interface and robust security measures, PayPal simplifies the payment process, making it a popular choice for e-commerce stores in the UAE and beyond.

Key Features:

- Global Reach: Accept payments from over 200 countries and regions.

- Multi-Currency Support: Handle multiple currencies, including AED, to cater to international customers.

- Secure Transactions: Advanced fraud prevention and buyer protection features ensure secure transactions.

- Easy Integration: Seamlessly integrate PayPal with popular e-commerce platforms like Shopify, Magento, WooCommerce, and more.

- Mobile Payments: Enable customers to pay using their mobile devices with PayPal’s mobile-optimized solutions.

- Recurring Payments: Set up subscription services and automatic billing for recurring transactions.

- Comprehensive Reporting: Access detailed transaction reports and analytics to track your business performance.

Pricing:

- Domestic Transactions: 2.9% + AED 1.00 per transaction.

- International Transactions: 3.9% + fixed fee based on the currency received.

- No Setup Fees: Start using PayPal without any upfront costs.

- No Monthly Fees: Pay only when you start selling.

With its extensive feature set and reliable service, PayPal is an excellent payment gateway option for businesses in the UAE looking to expand their online sales and reach a global audience.

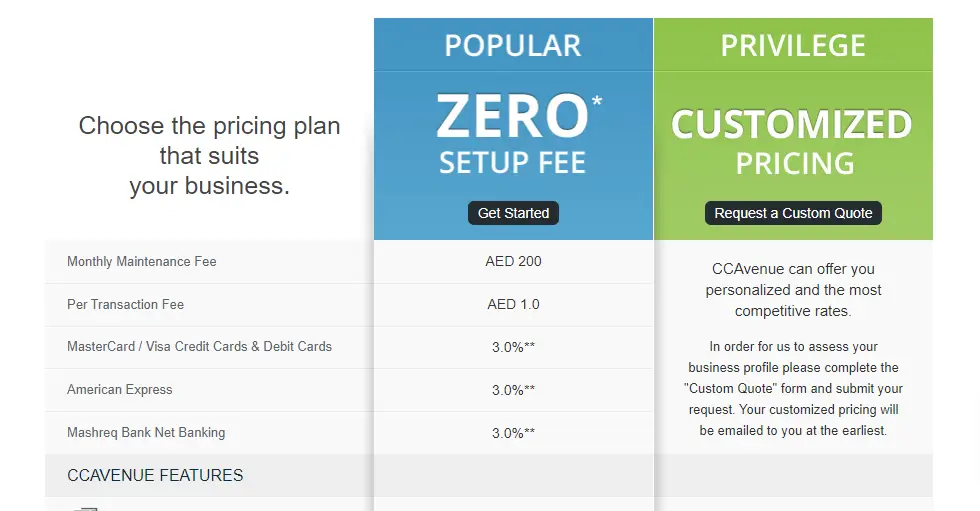

#6. CCAvenue

CCAvenue is one of the leading payment gateways in the UAE that supports Shopify integration. Known for its extensive range of payment options and robust features, CCAvenue provides a comprehensive solution for e-commerce businesses looking to streamline their online payment processes.

Key Features:

- Maximum Payment Options: CCAvenue supports a wide variety of payment methods, including credit and debit cards, net banking, digital wallets, and more. This ensures that customers have multiple ways to pay, enhancing their shopping experience.

- Multiple Currency Processing: CCAvenue allows businesses to accept payments in multiple currencies, making it easier to cater to international customers. This feature is particularly beneficial for e-commerce stores looking to expand their global reach.

- iFrame Integration: The iFrame integration feature enables a seamless and secure checkout experience without redirecting customers away from the website. This ensures a smooth and consistent user experience.

- High Security: CCAvenue provides advanced security features such as PCI DSS compliance, fraud detection, and 128-bit SSL encryption to protect customer data and transactions.

- Real-Time Reporting: Access real-time reports and analytics to monitor your transactions, sales performance, and customer behavior, helping you make informed business decisions.

- Easy Integration: CCAvenue offers easy and quick integration with popular e-commerce platforms like Shopify, Magento, WooCommerce, and more, allowing you to set up and start accepting payments swiftly.

Pricing:

- Monthly Maintenance Fee: AED 200

- Per Transaction Fee: AED 1.0

- Transaction Fees:

- MasterCard / Visa Credit Cards & Debit Cards: 3.0%

- American Express: 3.0%

- Mashreq Bank Net Banking: 3.0%

#7. Network International (N-Genius)

Network International is one of the oldest and most established payment processing companies in the UAE, with over 30 years of experience in the industry. Known for its robust and reliable services, Network International has been a cornerstone in the region’s payment processing landscape.

In 2021, Network International achieved impressive milestones, processing over $42 billion in total processed volumes (TPV) for more than 150,000 merchants. Additionally, the company processed over 979 million issuer transactions on 16+ million cards for more than 200 financial institutions. This extensive experience underscores their reliability and trustworthiness in handling vast amounts of transactions securely.

N-Genius Platform: Network International’s new N-Genius platform offers advanced online payment solutions designed to support e-commerce transactions. This platform is tailored to help businesses in the UAE grow by providing a secure and efficient way to accept online payments. Here are some key features of the N-Genius platform:

- Comprehensive Payment Acceptance: N-Genius allows businesses to accept a wide range of payment methods, including credit and debit cards, digital wallets, and more, ensuring that customers have multiple payment options.

- Seamless Integration: The platform offers easy integration with e-commerce platforms such as Shopify, making it convenient for businesses to incorporate a secure payment gateway into their online stores.

- Advanced Security: N-Genius ensures that all transactions are protected with advanced security measures, including PCI DSS compliance and fraud detection systems, providing peace of mind to both merchants and customers.

- Scalability: The platform is designed to support businesses of all sizes, from small enterprises to large corporations, offering scalability as the business grows.

- Real-Time Reporting: Access detailed real-time reports and analytics to monitor transaction history, sales performance, and customer behavior, aiding in strategic decision-making.

N-Genius provides a seamless and secure way to accept online payments, supporting a wide range of payment methods and currencies, which is essential for businesses looking to expand globally. Key features include an easy-to-use customer portal, multi-currency acceptance, 3D Secure authentication, tokenization, subscription management, and enhanced fraud protection. The platform integrates effortlessly with various e-commerce sites and applications, including WordPress, WooCommerce, Magento, OpenCart, and PrestaShop.

For businesses requiring customized solutions and high sales volumes, Network International offers bespoke pricing and support options through its “Custom Quote” service. This ensures that businesses receive the most competitive rates tailored to their specific needs (Network International) (Network International).

#8. HyperPay

HyperPay is a leading fintech company in the MENA region, offering a comprehensive suite of integrated payment solutions and financial services. As the region shifts towards a cashless society, HyperPay aims to enhance both individuals’ lives and business growth through its dynamic array of services. Their gateway is PCI-DSS compliant, ensuring top-tier security standards, and their platform is fully certified for integrations and various products.

HyperPay provides a reliable and secure payment processing service, making it a popular choice for businesses looking to streamline their payment operations in the Middle East and North Africa. This includes support for various payment methods, multi-currency processing, and advanced fraud protection, ensuring a smooth and secure transaction experience for both merchants and customers.

Pricing

HyperPay customizes its pricing based on the needs and transaction volumes of the businesses it serves. Typically, this involves a negotiation process to determine the most suitable rates for each merchant. To get an accurate quote, businesses are encouraged to contact HyperPay directly to discuss their specific requirements and volume expectations.

For more information, you can visit HyperPay’s official website or get in touch with their sales team directly.

FAQs

- What are the main payment gateways supported by Shopify in the UAE?

- Shopify supports multiple payment gateways in the UAE, including PayTabs, Telr, CCAvenue, 2Checkout, and Network International (N-Genius).

- Can I use PayPal with Shopify in the UAE?

- Yes, PayPal is supported by Shopify in the UAE and can be used for processing payments in AED.

- What currencies do the supported payment gateways accept?

- The supported payment gateways generally accept multiple currencies, including AED, USD, EUR, and others. Each gateway may have its specific supported currencies list.

- Is there any setup fee for integrating payment gateways with Shopify in the UAE?

- Some payment gateways might charge a setup fee, while others do not. For example, PayTabs and Telr typically have no setup fees, while CCAvenue may charge one.

- What transaction fees can I expect from these payment gateways?

- Transaction fees vary by gateway. For example, PayTabs charges around 2.85% + AED 1 per transaction, while others like Stripe (not currently supported in the UAE) charge 2.9% + AED 1.

- How do I integrate a payment gateway with my Shopify store?

- Integration involves signing up with the payment gateway, obtaining the API keys, and configuring them in the Shopify payment settings.

- Do these payment gateways support multi-currency transactions?

- Yes, many of the supported payment gateways like PayTabs and CCAvenue support multi-currency transactions, which is beneficial for international sales.

- What payment methods are accepted by these gateways?

- The gateways accept various payment methods including credit cards, debit cards, bank transfers, and alternative payment methods like Apple Pay.

- Is PCI compliance required for using these gateways?

- Yes, all the supported payment gateways are PCI-DSS compliant, ensuring secure transactions for your customers.

- What documentation is required to set up a payment gateway in the UAE?

- Typically, you need business registration documents, a trade license, bank account details, and personal identification documents of the business owners.

Conclusion

In conclusion, Shopify’s support for various payment gateways in the UAE offers businesses flexibility and security in handling online transactions. With options like PayTabs, Telr, CCAvenue, and 2Checkout, merchants can choose the gateway that best suits their needs. Each gateway provides unique features, competitive pricing, and compliance with international standards, ensuring smooth and reliable payment processing. Whether you’re a small startup or a large enterprise, these integrations can enhance your e-commerce operations, facilitating growth and expanding your market reach in the UAE and beyond.

How Seamedia E-commerce Solutions Can Help You?

At Seamedia, we specialize in providing comprehensive e-commerce solutions tailored to meet the needs of businesses in the UAE. Our team of certified professionals excels in developing and customizing Shopify stores, ensuring seamless integration with various payment gateways like PayTabs, Telr, and CCAvenue. This allows you to accept payments securely and efficiently in AED, enhancing your customers’ shopping experience.

Additionally, our expertise extends to optimizing your online store for performance and scalability. From setting up multi-currency processing to integrating advanced marketing tools, we ensure your e-commerce platform is equipped to handle growth and drive sales. Trust Seamedia to deliver robust solutions that elevate your online business in the competitive UAE market.

Afrikaans

Afrikaans Albanian

Albanian Amharic

Amharic Arabic

Arabic Armenian

Armenian Azerbaijani

Azerbaijani Basque

Basque Belarusian

Belarusian Bengali

Bengali Bosnian

Bosnian Bulgarian

Bulgarian Catalan

Catalan Cebuano

Cebuano Chichewa

Chichewa Chinese (Simplified)

Chinese (Simplified) Chinese (Traditional)

Chinese (Traditional) Corsican

Corsican Croatian

Croatian Czech

Czech Danish

Danish Dutch

Dutch English

English Esperanto

Esperanto Estonian

Estonian Filipino

Filipino Finnish

Finnish French

French Frisian

Frisian Galician

Galician Georgian

Georgian German

German Greek

Greek Gujarati

Gujarati Haitian Creole

Haitian Creole Hausa

Hausa Hawaiian

Hawaiian Hebrew

Hebrew Hindi

Hindi Hmong

Hmong Hungarian

Hungarian Icelandic

Icelandic Igbo

Igbo Indonesian

Indonesian Irish

Irish Italian

Italian Japanese

Japanese Javanese

Javanese Kannada

Kannada Kazakh

Kazakh Khmer

Khmer Korean

Korean Kurdish (Kurmanji)

Kurdish (Kurmanji) Kyrgyz

Kyrgyz Lao

Lao Latin

Latin Latvian

Latvian Lithuanian

Lithuanian Luxembourgish

Luxembourgish Macedonian

Macedonian Malagasy

Malagasy Malay

Malay Malayalam

Malayalam Maltese

Maltese Maori

Maori Marathi

Marathi Mongolian

Mongolian Myanmar (Burmese)

Myanmar (Burmese) Nepali

Nepali Norwegian

Norwegian Pashto

Pashto Persian

Persian Polish

Polish Portuguese

Portuguese Punjabi

Punjabi Romanian

Romanian Russian

Russian Samoan

Samoan Scottish Gaelic

Scottish Gaelic Serbian

Serbian Sesotho

Sesotho Shona

Shona Sindhi

Sindhi Sinhala

Sinhala Slovak

Slovak Slovenian

Slovenian Somali

Somali Spanish

Spanish Sundanese

Sundanese Swahili

Swahili Swedish

Swedish Tajik

Tajik Tamil

Tamil Telugu

Telugu Thai

Thai Turkish

Turkish Ukrainian

Ukrainian Urdu

Urdu Uzbek

Uzbek Vietnamese

Vietnamese Welsh

Welsh Xhosa

Xhosa Yiddish

Yiddish Yoruba

Yoruba Zulu

Zulu